香港公司章程样本

最佳答案

赞同来自: TeeVa 、Wde2014 、离岸新手 、小快车 、hahaha更多 »

pdf版 你自己下载吧

香港公司章程英文版样本:https://www.liankuaiche.com/fi ... 2OGYz

香港公司章程中文版样本:https://www.liankuaiche.com/fi ... 2MGMw

ARTICLES OF ASSOCIATION FOR

PRIVATE COMPANIES LIMITED BY SHARES

(Simplified Form)

Sample A is aSimplified Form of Articles of Associationfor private companies limited by sharesprepared on the assumption that the company adopting it will simplify its administration as far aspossible under the Companies Ordinance (Cap 622). For example,

(a)the company has only one class of shares and they are fully paid; and

(b)the directors do not appoint alternate directors.

As a result, it may be more appropriate for small owner-managed businesses.For the sake of brevity,statutory provisions are, as far as possible, not repeated.

Provisions on the following matters in the Model Articles of Association for private companies limitedby shares prescribed in Schedule 2 of the Companies (Model Articles) Notice (Cap. 622H) (“Schedule2”) are not included in Sample A –

- Committees (Article 6 of Schedule 2 and the corresponding references in Schedule 2);

- Alternate directors (Articles 15, 28 to 30 of Schedule 2 and the corresponding references inSchedule 2);

- Composite resolution (Article 24 of Schedule 2)

- Classes of shares (Articles 55 and 57 of Schedule 2 and the corresponding references inSchedule 2)

- Consolidated shares certificates (Article 61 of Schedule 2 and the correspondingreferences in Schedule2);

- and Auditors’ insurance (Article 83 of Schedule 2).

Companies may adoptSample A as they see fit.Companies or their officers should consult theirprofessional advisors on any matters which may affect them relating to or arising out of the adoption ofthe Articles of Association in Sample A.

THE COMPANIES OR DINANCE (CHAPTER 622)

Private Company Limited by Shares

ARTICLES OF ASSOCIATION

OF

[ENGLISH COMPANY NAME]

[CHINESE COMPANY NAME

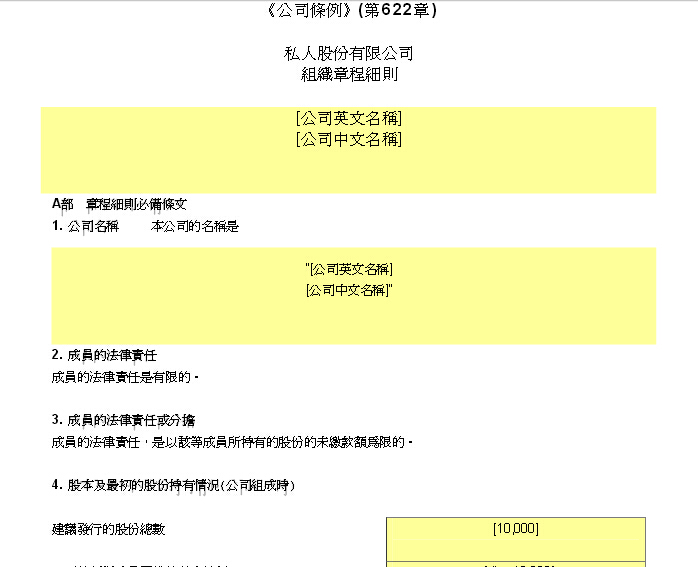

Part A Mandatory Articles

1.Company Name The name of the company is

“

[ENGLISH COMPANY NAME]

[CHINESE COMPANY NAME]

”

2.Members’ Liabilities

The liability of the members is limited.

3.Liabilities or Contributions of Members

The liability of the members is limited to any amount unpaid on the shares held by the members.

4.Share Capital and Initial Shareholdings (on the company's formation)

The total number of shares that the company proposes to issue

The total amount of share capital to be subscribed by the company’s founder members

(i) The amount to be paid up or to be regarded as paid up

(ii) The amount to remain unpaid or to be regarded as remaining unpaid

Class of Shares

The total number of shares in this class that the company proposes to issue

The total amount of share capital in this class to be subscribed by the company’s founder members

(i) The amount to be paid up or to be regarded as paid up

(ii) The amount to remain unpaid or to be regarded as remaining unpaid

I/WE, the undersigned, wish to form a company and wish to adopt the articles of association asattached, and I/we respectively agree to subscribe for the amount of share capital of the Company andto take the number of shares in the Company set opposite my/our respective name(s).

Part B Other Articles

Part 1

Interpretation

1.Interpretation

(1) In these articles—

articles(本《章程細則》) means the articles of association of the company;

associated company(有聯繫公司) means—

(a) a subsidiary of the company;

(b) a holding company of the company; or

(c) a subsidiary of such a holding company;

distribution recipient(分派對象) means, in relation to a share in respect of which a dividend or other sum is payable—

(a) the holder of the share;

(b) if the share has 2 or more joint holders, whichever of them is named first in the register of members; or

(c) if the holder is no longer entitled to the share by reason of death or bankruptcy or otherwise

by operation of law, the transmittee;

fully paid (已繳足款), in relation to a share, means the price at which the share was issued has been fully paid to the company;

holder(持有人), in relation to a share, means the person whose name is entered in the register of members as the holder of the share;

mental incapacity (精神上無行為能力) has the meaning given by section 2(1) of the Mental Health

Ordinance (Cap. 136);

mentally incapacitated person(精神上無行為能力者) means a person who is found under the Mental

Health Ordinance (Cap. 136) to be incapable, by reason of mental incapacity, of managing and

administering his or her property and affairs;

Ordinance(《條例》) means the Companies Ordinance (Cap. 622);

paid(已繳) means paid or credited as paid;

proxy notice(代表通知書)—see article 43(1);

register of members(成員登記冊) means the register of members of the company;transmittee (承傳人) means a person entitled to a share by reason of the death or bankruptcy of amember or otherwise by operation of law.

(2) Other words or expressions used in these articles have the same meaning as in the Ordinance as in force on the date these articles become binding on the company.

(3) For the purposes of these articles, a document is authenticated if it is authenticated in any way in which section 828(5) or 829(3) of the Ordinance provides for documents or information to be authenticated for the purposes of the Ordinance.

(4) The articles set out in Schedule 2 of the Companies (Model Articles) Notice (Cap. 622H) do not apply to the company.

Part 2

Private Company

2.Company is private company

(1) The company is a private company and accordingly—

(a) a member’s right to transfer shares is restricted in the manner specified in this article;

(b) the number of members is limited to 50; and

(c) any invitation to the public to subscribe for any shares or debentures of the company is prohibited.

(2) The directors may in their discretion refuse to register the transfer of a share.

(3) In paragraph (1)(b)— member(成員) excludes—

(a) a member who is an employee of the company; and

(b) a person who was a member while being an employee of the company and who continues to be a member after ceasing to be such an employee.

(4) For the purposes of this article, 2 or more persons who hold shares in the company jointly are to be regarded as 1 member.

Part 3

Directors and Company Secretary

Division 1—Directors’ Powers and Responsibilities

3.Directors' general authority

(1) Subject to the Ordinance and these articles, the business and affairs of the company are

managed by the directors, who may exercise all the powers of the company.

(2)

An alteration of these articles does not invalidate any prior act of the directors that would have

been valid if the alteration had not been made.

(3)

The powers given by this article are not limited by

any other power given to the directors by these

articles.

(4)

A directors’ meeting at which a quorum is present may exercise all powers exercisable by the

directors.

4.

Members’ reserve power

(1)

The members may, by special resolution, direct the directors to take, or refrain from taking,

specified action.

(2)

The special resolution does not invalidate anything that the directors have done before the

passing of the resolution.

5.

Directors may

delegate

(1)

Subject to these articles, the directors may, if they think fit, delegate any of the powers that are

conferred on them under these articles—

(a)

to any person;

(b)

by any means (including by power of attorney);

(c)

to any extent and without territorial limit;

(d)

in relation to any matter; and

(e)

on any terms and conditions.

(2)

If the directors so specify, the delegation may authorize further delegation of the directors’

powers by any person to whom they are delegated.

(3)

The directors may—

(a)

revoke the delegation wholly or in part; or

(b)

revoke or alter its terms and conditions.

Division 2—Decision-taking by Directors

6.

Directors to take decision collectivel

y

(1)

A decision of the directors may only be taken—

(a)

by a majority of the directors at a meeting; or

(b)

in accordance with article 7.

(2)

Paragraph (1) does not apply if—

(a)

the company only has 1 director; and

(b)

no provision of these articles requires it to have more than one director.

(3)

If paragraph (1) does not apply, the director may take decisions without regard to any of the

provisions of these articles relating to directors’ decision-taking.

7.

Unanimous

decisions

(1)

A decision of the directors is taken in accordance with this article when all eligible directors

indicate to each other (either directly or indire

ctly) by any means that they share a common view

on a matter.

(2)

Such a decision may take the form of a resolution in writing, copies of which have been signed by

each eligible director or to which each eligible director has otherwise indicated agreement in

writing.

(3)

A reference in this article to eligible directors is a reference to directors who would have been

entitled to vote on the matter if it had been proposed as a resolution at a directors’ meeting.

(4)

A decision may not be taken in accordance with this article if the eligible directors would not have

formed a quorum at a directors’ meeting.

8.

Calling directors’ meetings

(1)

Any director may call a directors’ meeting by gi

ving notice of the meeting to the directors or by

authorizing the company secretary to give such notice.

(2)

Notice of a directors’ meeting must indicate—

(a)

its proposed date and time; and

(b)

where it is to take place.

(3)

Notice of a directors’ meeting must be given to each director, but need not be in writing.

9.

Participation in directors’ meetings

(1)

Subject to these articles, directors participate in a directors’ meeting, or part of a directors’

meeting, when—

(a)

the meeting has been called and takes place in accordance with these articles; and

(b)

they can each communicate to the others

any information or opinions they have on any

particular item of the business of the meeting.

(2)

In determining whether directors are participating in

a directors’ meeting, it is irrelevant where a

director is and how they communicate with each other.

(3)

If all the directors participating in a directors’ meeting are not in the same place, they may regard

the meeting as taking place wherever any one of them is.

10.

Quorum for directors’ meetings

(1)

At a directors’ meeting, unless a quorum is participating, no proposal is to be voted on, except a

proposal to call another meeting.

(2)

The quorum for directors’ meetings may be fixed from time to time by a decision of the directors

and unless otherwise fixed it is 2 unless there is a sole director, in which case the quorum is 1.

11.

Meetings if total number of directors less than quorum

If the total number of directors for the time being is less than the quorum required for directors’

meetings, the directors must not take any decision other than a decision—

(a)

to appoint further directors; or

(b)

to call a general meeting so as to enable the members to appoint further directors.

12.

Chairing of directors’ meetings

(1)

The directors may appoint a director to chair their meetings.

(2)

The person appointed for the time being is known as the chairperson.

(3)

The directors may terminate the appointment of the chairperson at any time.

(4)

If the chairperson is not participating in a directors’ meeting within 10 minutes of the time at which

it was to start or is unwilling to chair the meeting, the participating directors may appoint one of

themselves to chair it.

13.

Chairperso

n’s casting vote at directors’ meetings

(1)

If the numbers of votes for and against a proposal are equal, the chairperson or other director

chairing the directors’ meeting has a casting vote.

(2)

Paragraph (1) does not apply if, in accordance with these articles, the chairperson or other

director is not to be counted as participating in the decision-making process for quorum or voting

purposes.

14.

Conflicts of interest

(1)

This article applies if—

(a)

a director is in any way (directly or indirectly) interested in a transaction, arrangement or

contract with the company that is significant in relation to the company’s business; and

(b)

the director’s interest is material.

(2)

The director must declare the nature and extent of the director’s interest to the other directors in

accordance with section 536 of the Ordinance.

(3)

The director must neither—

(a)

vote in respect of the transaction, arrangement or contract in which the director is so

interested; nor

(b)

be counted for quorum purposes in respect of the transaction, arrangement or contract.

(4)

If the director contravenes paragraph (3)(a), the vote must not be counted.

(5)

Paragraph (3) does not apply to—

(a)

an arrangement for giving a director any securi

ty or indemnity in res

pect of money lent by

the director to or obligations undertaken by the director for the benefit of the company;

(b)

an arrangement for the company to give any secu

rity to a third party in respect of a debt or

obligation of the company for which the director has assumed responsibility wholly or in part

under a guarantee or indemnity or by the deposit of a security;

(c)

an arrangement under which benefits are made available to employees and directors or

former employees and directors of the company

or any of its subsidiaries, which do not

provide special benefits for directors or former directors; or

(d)

an arrangement to subscribe for or underwrite shares.

(6)

A reference in this article (except in paragraphs (5)(d) and (7)) to a transaction, arrangement or

contract includes a proposed transaction, arrangement or contract.

(7)

In this article—

arrangement to subscribe for or underwrite shares

(

認購或包銷股份安排

) means—

(a)

a subscription or proposed subscription for shares or other securities of the company;

(b)

an agreement or proposed agreement to subscribe for shares or other securities of the

company; or

(c)

an agreement or proposed agreement to underwrite any of those shares or securities.

Supplementary provisions as to conflicts of interest

(1)

A director may hold any other office or position of profit under the company (other than the office

of auditor and if the company has only 1 director, the office of company secretary) in conjunction

with the office of director for a period and on terms (as to remuneration or otherwise) that the

directors determine.

(2)

A director or intending director is not disqualified by the office of director from contracting with the

company—

(a)

with regard to the tenure of the other office or position of profit mentioned in paragraph (1);

or

(b)

as vendor, purchaser or otherwise.

(3)

The contract mentioned in paragraph (2) or any transaction, arrangement or contract entered into

by or on behalf of the company in which any direct

or is in any way interested is not liable to be

avoided.

(4)

A director who has entered into a contract mentioned in paragraph (2) or is interested in a

transaction, arrangement or contract mentioned in paragraph (3) is not liable to account to the

company for any profit realized by the transac

tion, arrangement or contract by reason of—

(a)

the director holding the office; or

(b)

the fiduciary relation established by the office.

(5)

Paragraph (1), (2), (3) or (4) only applies if the director has declared the nature and extent of the

director’s interest under the paragraph to the other directors in accordance with section 536 of

the Ordinance.

(6)

A director of the company may be a director or other officer of, or be otherwise interested in—

(a)

any company promoted by the company; or

(b)

any company in which the company may be interested as shareholder or otherwise.

(7)

Subject to the Ordinance, the director is not accountable to the company for any remuneration or

other benefits received by the director as a director or

officer of, or from the director’s interest in,

the other company unless the company otherwise directs.

Validity of acts of meeting of directors

The acts of any meeting of directors or the acts of any person acting as a director are as valid as if the

directors or the person had been duly appointed as a director and was qualified to be a director, even if

it is afterwards discovered that—

(a)

there was a defect in the appointment of any of the directors or of the person acting as a

director;

(b)

any one or more of them were not qualified to be a director or were disqualified from being a

director;

(c)

any one or more of them had ceased to hold office as a director; or

(d)

any one or more of them were not entitled to vote on the matter in question.

Record of decisions to be kept

The directors must ensure that the company keeps a written record of every decision taken by the

directors under article 6(1) for at leas

t 10 years from the date of the decision.

Written record of decision of sole director

(1)

This article applies if the company has only 1 director and the director takes any decision that—

(a)

may be taken in a directors’ meeting; and

(b)

has effect as if agreed in a directors’ meeting.

(2)

The director must provide the company with a written record of the decision within 7 days after

the decision is made.

(3)

The director is not required to comply with paragraph (2) if the decision is taken by way of a

resolution in writing.

(4)

If the decision is taken by way of a resolution in writing, the company must keep the resolution for

at least 10 years from the date of the decision.

(5)

The company must also keep a written record provided to it in accordance with paragraph (2) for

at least 10 years from the date of the decision.- Directors’ discretion to make further rules

Subject to these articles, the directors may make any rule that they think fit about—

(a)

how they take decisions; and

(b)

how the rules are to be recorded or communicated to directors. - Supplementary provisions as to conflicts of interest

(1)

A director may hold any other office or position of profit under the company (other than the office

of auditor and if the company has only 1 director, the office of company secretary) in conjunction

with the office of director for a period and on terms (as to remuneration or otherwise) that the

directors determine.

(2)

A director or intending director is not disqualified by the office of director from contracting with the

company—

(a)

with regard to the tenure of the other office or position of profit mentioned in paragraph (1);

or

(b)

as vendor, purchaser or otherwise.

(3)

The contract mentioned in paragraph (2) or any transaction, arrangement or contract entered into

by or on behalf of the company in which any direct

or is in any way interested is not liable to be

avoided.

(4)

A director who has entered into a contract mentioned in paragraph (2) or is interested in a

transaction, arrangement or contract mentioned in paragraph (3) is not liable to account to the

company for any profit realized by the transac

tion, arrangement or contract by reason of—

(a)

the director holding the office; or

(b)

the fiduciary relation established by the office.

(5)

Paragraph (1), (2), (3) or (4) only applies if the director has declared the nature and extent of the

director’s interest under the paragraph to the other directors in accordance with section 536 of

the Ordinance.

(6)

A director of the company may be a director or other officer of, or be otherwise interested in—

(a)

any company promoted by the company; or

(b)

any company in which the company may be interested as shareholder or otherwise.

(7)

Subject to the Ordinance, the director is not accountable to the company for any remuneration or

other benefits received by the director as a director or

officer of, or from the director’s interest in,

the other company unless the company otherwise directs.

Validity of acts of meeting of directors

The acts of any meeting of directors or the acts of any person acting as a director are as valid as if the

directors or the person had been duly appointed as a director and was qualified to be a director, even if

it is afterwards discovered that—

(a)

there was a defect in the appointment of any of the directors or of the person acting as a

director;

(b)

any one or more of them were not qualified to be a director or were disqualified from being a

director;

(c)

any one or more of them had ceased to hold office as a director; or

(d)

any one or more of them were not entitled to vote on the matter in question.

Record of decisions to be kept

The directors must ensure that the company keeps a written record of every decision taken by the

directors under article 6(1) for at leas

t 10 years from the date of the decision.

Written record of decision of sole director

(1)

This article applies if the company has only 1 director and the director takes any decision that—

(a)

may be taken in a directors’ meeting; and

(b)

has effect as if agreed in a directors’ meeting.

(2)

The director must provide the company with a written record of the decision within 7 days after

the decision is made.

(3)

The director is not required to comply with paragraph (2) if the decision is taken by way of a

resolution in writing.

(4)

If the decision is taken by way of a resolution in writing, the company must keep the resolution for

at least 10 years from the date of the decision.

(5)

The company must also keep a written record provided to it in accordance with paragraph (2) for

at least 10 years from the date of the decision.

Directors’ discretion to make further rules

Subject to these articles, the directors may make any rule that they think fit about—

(a)

how they take decisions; and

(b)

how the rules are to be recorded or communicated to directors.

(ii)

a sum payable by way of a penalty in respect of non-compliance with any requirement

of a regulatory nature; or

(b)

any liability incurred by the director—

(i)

in defending criminal proceedings in which the director is convicted;

(ii)

in defending civil proceedings brought by

the company, or an associated company of

the company, in which judgment is given against the director;

(iii)

in defending civil proceedings brought

on behalf of the company by a member of the

company or of an associated company of t

he company, in which judgment is given

against the director;

(iv)

in defending civil proceedings brought on behalf of an associated company of the

company by a member of the associated co

mpany or by a member of an associated

company of the associated company, in which judgment is given against the director;

or

(v)

in connection with an application for relief under section 903 or 904 of the Ordinance

in which the Court refuses to grant the director relief.

(3)

A reference in paragraph (2)(b) to a conviction, judgment or refusal of relief is a reference to the

final decision in the proceedings.

(4)

For the purposes of paragraph (3), a conviction, judgment or refusal of relief—

(a)

if not appealed against, becomes final at the end of the period for bringing an appeal; or

(b)

if appealed against, becomes final when the app

eal, or any further appeal, is disposed of.

(5)

For the purposes of paragraph (4)(b), an appeal is disposed of if—

(a)

it is determined, and the period for bringing any further appeal has ended; or

(b)

it is abandoned or otherwise ceases to have effect.

26.

Insurance

The directors may decide to purchase and maintain insurance, at the expense of the company, for a

director of the company, or a director of

an associated company of the company, against—

(a)

any liability to any person attaching to the director in connection with any negligence,

default, breach of duty or breach of trust (except for fraud) in relation to the company or

associated company (as the case may be); or

(b)

any liability incurred by the director in defending any proceedings (whether civil or criminal)

taken against the director for any negligence, default, breach of duty or breach of trust

(including fraud) in relation to the company or associated company (as the case may be).

Division 5—Company Secretary

27.

Appointment and removal of company secretary

(1)

The directors may appoint a company secretary for a term, at a remuneration and on conditions

they think fit.

(2)

The directors may remove a company secretary appointed by them.

Part 4

Decision-taking by Members

Division 1—Organization of General Meetings

28.

General meetings

(1)

Subject to sections 611, 612 and 613 of the Ordinance, the company must, in respect of each

financial year of the company, hold a general meeting as its annual general meeting in

accordance with section 610 of the Ordinance.

(2)

The directors may, if they think fit, call a general meeting.

(3)

If the directors are required to call a general meeting under section 566 of the Ordinance, they

must call it in accordance with section 567 of the Ordinance.

(4)

If the directors do not call a general meeting in accordance with section 567 of the Ordinance, the

members who requested the meeting, or any of them representing more than one half of the total

voting rights of all of them, may themselves call a general meeting in accordance with section

568 of the Ordinance.

29.

Notice of general meetings

(1)

An annual general meeting must be called by notice of at least 21 days in writing.

(2)

A general meeting other than an annual general meeting must be called by notice of at least 14

days in writing.

(3)

The notice is exclusive of—

(a)

the day on which it is served or deemed to be served; and

(b)

the day for which it is given.

(4)

The notice must—

(a)

specify the date and time of the meeting;

(b)

specify the place of the meeting (and if the meeting is to be held in 2 or more places, the

principal place of the meeting and the other place or places of the meeting);

(c)

state the general nature of the business to be dealt with at the meeting;

(d)

for a notice calling an annual general meeting, state that the meeting is an annual general

meeting;

(e)

if a resolution (whether or not a special resolution) is intended to be moved at the meeting—

(i)

include notice of the resolution; and

(ii)

include or be accompanied by a statement

containing any information or explanation

that is reasonably necessary to indicate the purpose of the resolution;

(f)

if a special resolution is intended to be moved at the meeting, specify the intention and

include the text of the special resolution; and

(g)

contain a statement specifying a member’s right to appoint a proxy under section 596(1)

and (3) of the Ordinance.

(5)

Paragraph (4)(e) does not apply in relation to a resolution of which—

(a)

notice has been included in the notice of the meeting under section 567(3) or 568(2) of the

Ordinance; or

(b)

notice has been given under section 615 of the Ordinance.

(6)

Despite the fact that a general meeting is called by shorter notice than that specified in this

article, it is regarded as having been duly called if it is so agreed—

(a)

for an annual general meeting, by all the members entitled to attend and vote at the

meeting; and

(b)

in any other case, by a majority in number of the members entitled to attend and vote at the

meeting, being a majority together representing at least 95% of the total voting rights at the

meeting of all the members.

30.

Persons entitled to receive notice of general meetings

(1)

Notice of a general meeting must be given to—

(a)

every member; and

(b)

every director.

(2)

In paragraph (1), the reference to a member

includes a transmittee, if the company has been

notified of the transmittee’s entitlement to a share.

(3)

If notice of a general meeting or any other document relating to the meeting is required to be

given to a member, the company must give a copy of it to its auditor (if more than one auditor, to

everyone of them) at the same time as the notice or the other document is given to the member.

31.

Accidental omission to give notice of general meetings

Any accidental omission to give notice of a general meeting to, or any non-receipt of notice of a

general meeting by, any person entitled to receive

notice does not invalidate the proceedings at the

meeting.

32.

Attendance and speaking at general meetings

(1)

A person is able to exercise the right to s

peak at a general meeting when the person is in a

position to communicate to all those attending the meeting, during the meeting, any information

or opinions that the person has on the business of the meeting.

(2)

A person is able to exercise the right to vote at a general meeting when—

(a)

the person is able to vote, during the meeting, on resolutions put to the vote at the meeting;

and

(b)

the person’s vote can be taken into account in determining whether or not those resolutions

are passed at the same time as the votes of all the other persons attending the meeting.

(3)

The directors may make whatever arrangements they consider appropriate to enable those

attending a general meeting to exercise their rights to speak or vote at it.

(4)

In determining attendance at a general meeting, it is immaterial whether any 2 or more members

attending it are in the same place as each other.

(5)

Two or more persons who are not in the same place as each other attend a general meeting if

their circumstances are such that if they have rights to speak and vote at the meeting, they are

able to exercise them.

33.

Quorum for general meetings

(1)

Two members present in person or by proxy constitute a quorum at a general meeting. If the

company has only one member, that member present in person or by proxy constitutes a quorum

at a general meeting of the company.

(2)

No business other than the appointment of the chairperson of the meeting is to be transacted at a

general meeting if the persons attending it do not constitute a quorum.

34.

Chairing general meetings

(1)

If the chairperson (if any) of the board of directors is present at a general meeting and is willing to

preside as chairperson at the meeting, the m

eeting is to be presided over by him or her.

(2)

The directors present at a general meeting must elect one of themselves to be the chairperson

if—

(a)

there is no chairperson of the board of directors;

(b)

the chairperson is not present within 15 minutes after the time appointed for holding the

meeting;

(c)

the chairperson is unwilling to act; or

(d)

the chairperson has given notice to the company of the intention not to attend the meeting.

(3)

The members present at a general meeting must elect one of themselves to be the chairperson

if—

(a)

no director is willing to act as chairperson; or

(b)

no director is present within 15 minutes after the time appointed for holding the meeting.

(4)

A proxy may be elected to be the chairperson of a general meeting by a resolution of the

company passed at the meeting.

35.

Attendance and speaking by non-members

(1)

Directors may attend and speak at general meetings, whether or not they are members of the

company.

(2)

The chairperson of a general meeting may permit other persons to attend and speak at a general

meeting even though they are not—

(a)

members of the company; or

(b)

otherwise entitled to exercise the rights of members in relation to general meetings.

36.

Adjournment

(1)

If a quorum is not present within half an hour from the time appointed for holding a general

meeting, the meeting must—

(a)

if called on the request of members, be dissolved; or

(b)

in any other case, be adjourned to the same day in the next week, at the same time and

place, or to another day and at another time and place that the directors determine.

(2)

If at the adjourned meeting, a quorum is not present within half an hour from the time appointed

for holding the meeting, the member or member

s present in person or by proxy constitute a

quorum.

(3)

The chairperson may adjourn a general meeting at which a quorum is present if—

(a)

the meeting consents to an adjournment; or

(b)

it appears to the chairperson that an adjournment is necessary to protect the safety of any

person attending the meeting or ensure that the business of the meeting is conducted in an

orderly manner.

(4)

The chairperson must adjourn a general meeting if directed to do so by the meeting.

(5)

When adjourning a general meeting, the chairperson must specify the date, time and place to

which it is adjourned.

(6)

Only the business left unfinished at the general meeting may be transacted at the adjourned

meeting.

(7)

If a general meeting is adjourned for 30 days or more, notice of the adjourned meeting must be

given as for an original meeting.

(8)

If a general meeting is adjourned for less than 30 days, it is not necessary to give any notice of

the adjourned meeting.

Division 2—Voting at General Meetings

37.

General rules on voting

(1)

A resolution put to the vote of a general meeting must be decided on a show of hands unless a

poll is duly demanded in accordance with these articles.

(2)

If there is an equality of votes, whether on a show of hands or on a poll, the chairperson of the

meeting at which the show of hands takes place or at which the poll is demanded, is entitled to a

second or casting vote.

(3)

On a vote on a resolution on a show of hands at a general meeting, a declaration by the

chairperson that the resolution—

(a)

has or has not been passed; or

(b)

has passed by a particular majority,

is conclusive evidence of that fact without proof of the number or proportion of the votes recorded

in favour of or against the resolution.

(4)

An entry in respect of the declaration in the minutes of the meeting is also conclusive evidence of

that fact without the proof.

38.

Errors and disputes

(1)

Any objection to the qualification of any person voting at a general meeting may only be raised at

the meeting or adjourned meeting at which the vote objected to is tendered, and a vote not

disallowed at the meeting is valid.

(2)

Any objection must be referred to the chairperson of the meeting whose decision is final.

39.

Demanding a poll

(1)

A poll on a resolution may be demanded—

(a)

in advance of the general meeting where it is to be put to the vote; or

(b)

at a general meeting, either before or on the declaration of the result of a show of hands on

that resolution.

(2)

A poll on a resolution may be demanded by—

(a)

the chairperson of the meeting;

(b)

at least 2 members present in person or by proxy; or

(c)

any member or members present in person or

by proxy and representing at least 5% of the

total voting rights of all the members having the right to vote at the meeting.

(3)

The instrument appointing a proxy is regarded as conferring authority to demand or join in

demanding a poll on a resolution.

(4)

A demand for a poll on a resolution may be withdrawn.

40.

Number of votes a member has

(1)

On a vote on a resolution on a show of hands at a general meeting—

(a)

every member present in person has 1 vote; and

(b)

every proxy present who has been duly appointed by a member entitled to vote on the

resolution has 1 vote.

(2)

If a member appoints more than one proxy, the proxies so appointed are not entitled to vote on

the resolution on a show of hands.

(3)

On a vote on a resolution on a poll taken at a general meeting—

(a)

every member present in person has 1 vote for each share held by him or her; and

(b)

every proxy present who has been duly appointed by a member has 1 vote for each share

in respect of which the proxy is appointed.

(4)

This article has effect subject to any rights or restrictions attached to any shares or class of

shares.

41.

Votes of joint holders of shares

(1)

For joint holders of shares, only the vote of the most senior holder who votes (and any proxies

duly authorized by the holder) may be counted.

(2)

For the purposes of this article, the seniority of a holder of a share is determined by the order in

which the names of the joint holders appear in the register of members.

42.

Votes of mentally incapacitated members

(1)

A member who is a mentally incapacitated person may vote, whether on a show of hands or on a

poll, by the member’s committee, receiver, guardian or other person in the nature of a committee,

receiver or guardian appointed by the Court.

(2)

The committee, receiver, guardian or other person may vote by proxy on a show of hands or on a

poll.

43.

Content of proxy notices

(1)

A proxy may only validly be appointed by a notice in writing (

proxy notice

) that—

(a)

states the name and address of the member appointing the proxy;

(b)

identifies the person appointed to be that member’s proxy and the general meeting in

relation to which that person is appointed;

(c)

is authenticated, or is signed on behalf of the member appointing the proxy; and

(d)

is delivered to the company in accordance with these articles and any instructions

contained in the notice of the general meeting in relation to which the proxy is appointed.

(2)

The company may require proxy notices to be delivered in a particular form, and may specify

different forms for different purposes.

(3)

If the company requires or allows a proxy notice to be delivered to it in electronic form, it may

require the delivery to be properly protected

by a security arrangement it specifies.

(4)

A proxy notice may specify how the proxy appointed under it is to vote (or that the proxy is to

abstain from voting) on one or more resolutions dealing with any business to be transacted at a

general meeting.

(5)

Unless a proxy notice indicates otherwise, it must be regarded as—

(a)

allowing the person appointed under it as a proxy discretion as to how to vote on any

ancillary or procedural resolutions put to the general meeting; and

(b)

appointing that person as a proxy in relation to any adjournment of the general meeting to

which it relates as well as the meeting itself.

44.

Execution of appointment of proxy on behalf of member appointing the proxy

If a proxy notice is not authenticated, it must be accompanied by written evidence of the authority of

the person who executed the appointment to execute it on behalf of the member appointing the proxy.

45.

Delivery of proxy notice and notice revoking appointment of proxy

(1)

A proxy notice does not take effect unless it is received by the company—

(a)

for a general meeting or adjourned general meeting, at least 48 hours before the time

appointed for holding the meeting or adjourned meeting; and

(b)

for a poll taken more than 48 hours after it was demanded, at least 24 hours before the time

appointed for taking the poll.

(2)

An appointment under a proxy notice may be revoked by delivering to the company a notice in

writing given by or on behalf of the person by whom or on whose behalf the proxy notice was

given.

(3)

A notice revoking the appointment only takes effect if it is received by the company—

(a)

for a general meeting or adjourned general meeting, at least 48 hours before the time

appointed for holding the meeting or adjourned meeting; and

(b)

for a poll taken more than 48 hours after it was demanded, at least 24 hours before the time

appointed for taking the poll.

46.

Effect of member’s voting in person on proxy’s authority

(1)

A proxy’s authority in relation to a resolution

is to be regarded as revoked in the circumstances

set out in section 605 of the Ordinance.

(2)

A member who is entitled to attend, speak or vote (either on a show of hands or on a poll) at a

general meeting remains so entitled in respect of the meeting or any adjournment of it, even

though a valid proxy notice has been delivered to the company by or on behalf of the member.

47.

Effect of proxy votes in case of death, mental incapacity, etc. of member appointing the

proxy

(1)

A vote given in accordance with the terms of a proxy notice is valid despite—

(a)

the previous death or mental incapacity of the member appointing the proxy;

(b)

the revocation of the appointment of the proxy or of the authority under which the

appointment of the proxy is executed; or

(c)

the transfer of the share in respect of which the proxy is appointed.

(2)

Paragraph (1) does not apply if notice in writing of the death, mental incapacity, revocation or

transfer is received by the company—

(a)

for a general meeting or adjourned general meeting, at least 48 hours before the time

appointed for holding the meeting or adjourned meeting; and

(b)

for a poll taken more than 48 hours after it was demanded, at least 24 hours before the time

appointed for taking the poll.

48.

Amendments to proposed resolutions

(1)

An ordinary resolution to be proposed at a general meeting may be amended by ordinary

resolution if—

(a)

notice of the proposed amendment is given to the company secretary in writing; and

(b)

the proposed amendment does not, in the reasonable opinion of the chairperson of the

meeting, materially alter the scope of the resolution.

(2)

The notice must be given by a person entitled to vote at the general meeting at which it is to be

proposed at least 48 hours before the meeting is to take place (or a later time the chairperson of

the meeting determines).

(3)

A special resolution to be proposed at a general meeting may be amended by ordinary resolution

if—

(a)

the chairperson of the meeting proposes the amendment at the meeting at which the

special resolution is to be proposed; and

(b)

the amendment merely corrects a grammatical or other non-substantive error in the special

resolution.

(4)

If the chairperson of the meeting, acting in good faith, wrongly decides that an amendment to a

resolution is out of order, the vote on that resolution remains valid unless the Court orders

otherwise.

Part 5

Shares and Distributions

Division 1—Issue of Shares

49.

All shares to be fully paid up

No share is to be issued unless the share is fully paid.

Division 2—Interests in Shares

50.

Company only bound by absolute interests

(1)

Except as required by law, no person is to

be recognized by the company as holding any share

on any trust.

(2)

Except as otherwise required by law or these

articles, the company is not in any way to be bound

by or recognize any interest in a share other than the holder’s absolute ownership of it and all the

rights attaching to it.

(3)

Paragraph (2) applies even though the company has notice of the interest.

Division 3—Share Certificates

51.

Certificates to be issued except in certain cases

(1)

The company must issue each member, free of charge, with one or more certificates in respect of

the shares that the member holds, within—

(a)

2 months after allotment or lodgment of a proper instrument of transfer; or

(b)

any other period that the conditions of issue provide.

(2)

If more than one person holds a share, only 1 certificate may be issued in respect of it.

52.

Contents and execution of share certificates

(1)

A certificate must specify—

(a)

in respect of how many shares the certificate is issued;

(b)

the fact that the shares are fully paid; and

(c)

any distinguishing numbers assigned to them.

(2)

A certificate must—

(a)

have affixed to it the company’s common seal or the company’s official seal under section

126 of the Ordinance; or

(b)

be otherwise executed in accordance with the Ordinance.

53.

Replacement share certificates

(1)

If a certificate issued in respect of a member’s shares is defaced, damaged, lost or destroyed, the

member is entitled to be issued with a replacement certificate in respect of the same shares.

(2)

A member exercising the right to be issued with a replacement certificate—

(a)

must return the certificate that is to be replaced to the company if it is defaced or damaged;

and

(b)

must comply with the conditions as to evi

dence, indemnity and the payment of a reasonable

fee that the directors decide.

Division 4—Transfer and Transmission of Shares

54.

Transfer of shares

(1)

Shares may be transferred by means of an instrum

ent of transfer in any usual form or any other

form approved by the directors, which is executed by or on behalf of both the transferor and the

transferee.

(2)

No fee may be charged by the company for registering any instrument of transfer or other

document relating to or affecting the title to any share.

(3)

The company may retain any instrument of transfer that is registered.

(4)

The transferor remains the holder of a share until the transferee’s name is entered in the register

of members as holder of it.

55.

Power of directors to refuse transfer of shares

(1)

Without limiting article 2(2), the directors may refuse to register the transfer of a share if—

(a)

the instrument of transfer is not lodged at the company’s registered office or another place

that the directors have appointed;

(b)

the instrument of transfer is not accompanied by the certificate for the share to which it

relates, or other evidence the directors reasonably require to show the transferor’s right to

make the transfer, or evidence of the right of someone other than the transferor to make the

transfer on the transferor’s behalf; or

(c)

the transfer is in respect of more than one class of shares.

(2)

If the directors refuse to register the transfer of a share under paragraph (1) or article 2(2)—

(a)

the transferor or transferee may request a statement of the reasons for the refusal; and

(b)

the instrument of transfer must be returned to the transferor or transferee who lodged it

unless the directors suspect that the proposed transfer may be fraudulent.

(3)

The instrument of transfer must be returned in accordance with paragraph (2)(b) together with a

notice of refusal within 2 months after the date on which the instrument of transfer was lodged

with the company.

(4)

If a request is made under paragraph (2)(a), the directors must, within 28 days after receiving the

request—

(a)

send the transferor or transferee who made the request a statement of the reasons for the

refusal; or

(b)

register the transfer.

56.

Transmission of shares

If a member dies, the company may only recognize t

he following person or persons as having any title

to a share of the deceased member—

(a)

if the deceased member was a joint holder of the share, the surviving holder or holders of

the share; and

(b)

if the deceased member was a sole holder of the share, the legal personal representative of

the deceased member.

57.

Transmittees’ rights

(1)

If a transmittee produces evidence of entitlement to the share as the directors properly require,

the transmittee may, subject to these articles, choose to become the holder of the share or to

have the share transferred to another person.

(2)

The directors have the same right to refuse or suspend the registration as they would have had if

the holder had transferred the share before the transmission.

(3)

A transmittee is entitled to the same dividends and other advantages to which the transmittee

would be entitled if the transmittee were the holder of the share, except that the transmittee is

not, before being registered as a member in respect of the share, entitled in respect of it to

exercise any right conferred by membership

in relation to meetings of the company.

(4)

The directors may at any time give notice requiring a transmittee to choose to become the holder

of the share or to have the share transferred to another person.

(5)

If the notice is not complied with within 90 days of the notice being given, the directors may

withhold payment of all dividends, bonuses or othe

r moneys payable in respect of the share until

the requirements of the notice have been complied with.

58.

Exercise of transmittees’ rights

(1)

If a transmittee chooses to become the holder of a share, the transmittee must notify the

company in writing of the choice.

(2)

Within 2 months after receiving the notice, the directors must—

(a)

register the transmittee as the holder of the share; or

(b)

send the transmittee a notice of refusal of registration.

(3)

If the directors refuse registration, the transmittee may request a statement of the reasons for the

refusal.

(4)

If a request is made under paragraph (3), the directors must, within 28 days after receiving the

request—

(a)

send the transmittee a statement of the reasons for the refusal; or

(b)

register the transmittee as the holder of the share.

(5)

If the transmittee chooses to have the share transferred to another person, the transmittee must

execute an instrument of transfer in respect of it.

(6)

All the limitations, restrictions and other provisions of these articles relating to the right to transfer

and the registration of transfer of shares apply to the notice under paragraph (1) or the transfer

under paragraph (5), as if the transmission had not occurred and the transfer were a transfer

made by the holder of the share before the transmission.

Transmittees bound by prior notices

If a notice is given to a member in respect of shares and a transmittee is entitled to those shares, the

transmittee is bound by the notice if it was given to the member before the transmittee’s name has

been entered in the register of members.

Division 5—Alteration and Reduction of Share Capital, Share Buy-backs

and Allotment of Shares

Alteration of share capital

The company may by ordinary resolution alter its share capital in any one or more of the ways set out

in section 170(2)(a), (b), (c), (d), (e) and (f)(i) of the Ordinance, and section 170(3), (4), (5), (6), (7) and

(8) of the Ordinance applies accordingly.

Reduction of share capital

The company may by special resolution reduce its share capital in accordance with Division 3 of Part 5

of the Ordinance.

Share buy-backs

The company may buy back its own shares (including any redeemable shares) in accordance with

Division 4 of Part 5 of the Ordinance.

Allotment of shares

The directors must not exercise any power conferred on them to allot shares in the company without

the prior approval of the company by resolution

if the approval is required by section 140 of the

Ordinance.

Division 6—Distributions

Procedure for declaring dividends

(1)

The company may at a general meeting declare dividends, but a dividend must not exceed the

amount recommended by the directors.

(2)

The directors may from time to time pay the members interim dividends that appear to the

directors to be justified by the profits of the company.

(3)

A dividend may only be paid out of the profits in accordance with Part 6 of the Ordinance.

(4)

Unless the members’ resolution to declare or directors’ decision to pay a dividend, or the terms

on which shares are issued, specify otherwise, it must be paid by reference to each member’s

holding of shares on the date of the resolution or decision to declare or pay it.

(5)

Before recommending any dividend, the directors may set aside out of the profits of the company

any sums they think fit as reserves.

(6)

The directors may—

(a)

apply the reserves for any purpose to which the profits of the company may be properly

applied; and

(b)

pending such an application, employ the reserves in the business of the company or invest

them in any investments (other than shares of the company) that they think fit.

(7)

The directors may also without placing the sums

to reserve carry forward any profits that they

think prudent not to divide.- Payment of dividends and other distributions

(1)

If a dividend or other sum that is a distribution is payable in respect of a share, it must be paid by

one or more of the following means—

(a)

transfer to a bank account specified by the distribution recipient either in writing or as the

directors decide;

(b)

sending a cheque made payable to the distribu

tion recipient by post to the distribution

recipient at the distribution recipient’s registered address (if the distribution recipient is a

holder of the share), or (in any other case) to an address specified by the distribution

recipient either in writing or as the directors decide;

(c)

sending a cheque made payable to the specified person by post to the specified person at

the address the distribution recipient has specified either in writing or as the directors

decide;

(d)

any other means of payment as the directors agree with the distribution recipient either in

writing or as the directors decide.

(2)

In this article—

specified person

(

指明人士

) means a person specified by the distribution recipient either in writing or

as the directors decide. - No interest on distributions

The company may not pay interest on any dividend or other sum payable in respect of a share unless

otherwise provided by—

(a)

the terms on which the share was issued; or

(b)

the provisions of another agreement between the holder of the share and the company.

Unclaimed distributions

(1)

If dividends or other sums are payable in respec

t of shares and they are not claimed after having

been declared or become payable, they may be invested or made use of by the directors for the

benefit of the company until claimed.

(2)

The payment of the dividends or other sums into a separate account does not make the company

a trustee in respect of it.

(3)

A distribution recipient is no longer entitled to a dividend or other sum and it ceases to remain

owing by the company, if—

(a)

12 years have passed from the date on which the dividend or other sum became due for

payment; and

(b)

the distribution recipient has not claimed it.

Non-cash distributions

(1)

Subject to the terms of issue of the share in question, the company may, by ordinary resolution

on the recommendation of the directors, decide to pay all or part of a dividend or other

distribution payable in respect of a share by transferring non-cash assets of equivalent value

(including, without limitation, shares

or other securities in any company).

(2)

For paying a non-cash distribution, the directors may make whatever arrangements they think fit,

including, if any difficulty arises regarding the distribution—

(a)

fixing the value of any assets;

(b)

paying cash to any distribution recipient on the basis of that value in order to adjust the

rights of recipients; and

(c)

vesting any assets in trustees.

Waiver of distributions

(1)

Distribution recipients may waive their entitlement to a dividend or other distribution payable in

respect of a share by executing to the company a deed to that effect.

(2)

But if the share has more than one holder or more than one person is entitled to the share

(whether by reason of the death or bankruptcy of one or more joint holders, or otherwise), the

deed is not effective unless it is expressed to

be executed by all the holders or other persons

entitled to the share.

Division 7—Capitalization of Profits

Capitalization of profits

(1)

The company may by ordinary resolution on the recommendation of the directors capitalize

profits.

(2)

If the capitalization is to be accompanied by the issue of shares or debentures, the directors may

apply the sum capitalized in the proportions in which the members would be entitled if the sum

was distributed by way of dividend.

(3)

To the extent necessary to adjust the rights of the members among themselves if shares or

debentures become issuable in fractions, the directors may make any arrangements they think

fit, including the issuing of fractional certificates or the making of cash payments or adopting a

rounding policy.

Part 6

Miscellaneous Provisions

Division 1—Communications to and by Company

Means of communication to be used

(1)

Subject to these articles, anything sent or supplied by or to the company under these articles may

be sent or supplied in any way in which Part 18 of the Ordinance provides for documents or

information to be sent or supplied by or to the company for the purposes of the Ordinance.

(2)

Subject to these articles, any notice or document to be sent or supplied to a director in

connection with the taking of decisions by direct

ors may also be sent or supplied by the means

by which that director has asked to be sent or supplied with such a notice or document for the

time being.

(3)

A director may agree with the company that notices or documents sent to that director in a

particular way are to be deemed to have been received within a specified time of their being sent,

and for the specified time to be less than 48 hours.

Division 2—Administrative Arrangements

72.

Company s

eals

(1)

A common seal may only be used by the authority of the directors.

(2)

A common seal must be a metallic seal hav

ing the company’s name engraved on it in legible

form.

(3)

Subject to paragraph (2), the directors may decide by what means and in what form a common

seal or official seal (whether for use outside Hong Kong or for sealing securities) is to be used.

(4)

Unless otherwise decided by the directors, if t

he company has a common seal and it is affixed to

a document, the document must also be signed by at least 1 director of the company and 1

authorized person.

(5)

For the purposes of this article, an authorized person is—

(a)

any director of the company;

(b)

the company secretary; or

(c)

any person authorized by the directors for signing documents to which the common seal is

applied.

(6)

If the company has an official seal for use outside Hong Kong, it may only be affixed to a

document if its use on the document, or documents of a class to which it belongs, has been

authorized by a decision of the directors.

(7)

If the company has an official seal for sealing secu

rities, it may only be affixed to securities by the

company secretary or a person authorized to apply

it to securities by the company secretary.

73.

No right to

inspect accounts and other records

A person is not entitled

to inspect any of the company’s accounting or other records or documents

merely because of being a member, unless the person is authorized to do so by—

(a)

an enactment;

(b)

an order under section 740 of the Ordinance;

(c)

the directors; or

(d)

an ordinary resolution of the company.

74.

Winding

up

(1) If the company is wound up and a surplus remains after the payment of debts proved in the

winding up, the liquidator—

(a) may, with the required sanction, divide amongst the members in specie or kind the whole or

any part of the assets of the company (whether they consist of property of the same kind or

not) and may, for this purpose, set a value the liquidator thinks fair on any property to be so

divided; and

(b) may determine how the division is to be carried out between the members or different

classes of members.

(2) The liquidator may, with the required sanction, vest the whole or part of those assets in trustees

on trust for the benefit of the contributories that the liquidator, with the required sanction, thinks

fit, but a member must not be compelled to accept any shares or other securities on which there

is any liability.

(3) In this article—

required sanction(規定認許) means the sanction of a special resolution of the company and any

other sanction required by the Ordinance.

________

赞同来自: Faiox

香港公司的章程由章程大纲和章程细则两种文件构成。其重要性在于:

- 规定了公司内部管理的规则和程序;

- 由于它们是公开的文件,任何与公司交易的人都被视为已知道其内容。

公司章程大纲由于包括章程的基本规定并规定了公司的宗旨,对于同公司交易的第三者更为重要。章程细则侧重公司的内部管理并且规定诸如董事的任命、会议程序等事项,公司的股东和董事对此更为关切,因为此类规定将影响其权利义务。

《香港公司条例》附件一规定了公司章程大纲和章程细则的形式,要求公司予以采用,并可根据需要修改以适应其具体情况。这样,法律保证了有关公司管理的必要规定,并允许当事人有一定的灵活性。附件一包括了股份有限公司的章程细则模板(表A)、股份有限公司的章程大纲模板(表B)和无股本保证有限公司、有股本保证有限公司、有股本无限公司的章程大纲和章程细则模板(分别是表C、表D和表E)。

公司章程大纲的必要记载事项

根据《香港公司条例》的有关规定,公司章程大纲须包括下列事项:

- 公司名称;

- 公司法定地址;

- 公司宗旨(the objects of the company);

- 公司成员的责任;

- 公司股本;

- 法定地址;

- 组织条款。

公司章程大纲条款的法律规定

1、香港公司名称

股份有限公司或保证有限公司应以Limited作为其名称的最后用语。香港公司不得以下列名称登记:

- 与香港公司注册署公司名册已有名称相同的名称;

- 与根据香港条例组成或设立的法人实体名称相同的名称;

- 行政长官认为,该名称的使用将构成触犯刑法;或

- 行政长官认为,该名称冒犯或违反公共利益。

除非经行政长官同意,否则香港公司不得以下列名称注册:

British , Building Society , Chamber of Commerce , Chartered , Cooperative , Imperial , Kaifong , Mass Transit , Municipal , Royal , Savings , Tourist Association , Trust , Trustee ,UndergroundRailway 。

2、 公司法定地址

香港公司在香港应设有注册办事处。该处应是公司实际从事经营管理活动的地方。章程大纲应载明注册办事处的地址,以便香港政府、法院以及与公司有往来的第三者进行联系。该注册办事处如在公司设立后变更,应立即通知香港公司注册署,否则将被处以罚款。

3、 公司宗旨

宗旨条款规定了设立公司所追求的目标,并由此限制了公司的活动范围。其重要法律后果是,公司的活动如超越该条款规定的范围,即属越权行为而归于无效。公司具有明确的宗旨不仅使股东了解其投资的目的,也保护了与公司交易的第三人。

《香港公司条例》第5条只规定,各公司的章程大纲应规定公司的宗旨,但对宗旨条款的用语未作具体规定。传统上,宗旨条款通常以简单用语表述,法院也承认,公司表述的宗旨可自由解释。近来,在各公司的章程大纲中,普遍规定了冗长的宗旨条款,不仅包括公司设立时设计经营的业务,还包括公司将来可能经营的业务。这种实践反映了当事人的新认识,即公司可能迅速发展有利可图的副业,经过一段时期,副业可能变成比设立时的主业更为重要。

尽管现代趋势是在章程大纲中规定所有可能的公司活动,法院一般会承认在商务公司的宗旨中隐含一些权力,无须明文规定于章程大纲。

这类隐含权力包括:

- 借贷金钱和取得贷款而抵押财产;

- 个别出售公司财产(不是出售整个企业);

- 聘用和解雇雇员和代理人;

- 起诉和应诉;

- 支付奖金和退休金给雇员和前雇员。

1984年《香港公司条例(修正)》为在该条例实施后组建的公司简化了隐含权力的概念。根据第5条第5 款,此类公司除非在其章程大纲或章程细则中有明示排除或修改,均被视为具有在该条例附件7所列举的全部权力。在宗旨条款中,即使明示规定了公司的附属权力,在公司的主要宗旨未能适用时,附属权力亦归于无效。最常见的解决办法是在章程大纲中增加一条款,规定章程大纲的各条款均包含一个独立的主要宗旨。

4、公司成员(股东)的责任

股份有限公司或保证有限公司的章程大纲,必须表明其成员的责任是有限的。如果是董事、经理负无限责任的有限公司,还必须载明上述人员的无限责任。即使名称被允许免除“ Limited ”的有限公司,在此条款中也应表明其成员的责任是有限的。

如果是保证有限公司,还应规定有关保证的细节,包括各成员在公司结业时(作为成员时)保证缴付公司的数额。公司如在某成员终止其成员资格的一年内结业,该成员对其终止成员资格前公司发生的债务、公司结业的费用以及成员间捐助权利的评估费用仍应承担缴付责任。上述成员或前成员在公司结业时应缴付的数额,可规定以一定的数额为限。

无限公司的章程大纲可不规定公司成员的无限责任。然而,如果无限公司重新登记为有限公司,应在其章程大纲中作出有关成员责任的规定。

5、公司股本

股份有限公司的章程大纲应载明公司拟注册的授权股本总额、股份的划分方法及股票的票面价值。例如规定,授权股本总额为一千港元,分为一百股,每股十港元。

章程大纲的签署人至少应认缴一股。各签署人应与其名字相对应,记载其认缴的股份数。

6、组织条款(the association clause)

组织条款是章程大纲的最后条款。章程大纲的签署人(两人以上)应在此条款中表明其拟分别缴付的股份数额并宣称其组成为公司的意愿。签署人应在证人出席的情况下分别签署此条款。证人也应以合法的形式签署并表明其职务和地址,以示证实。

7、其它条款

除上述法定条款外,在公司章程大纲中可规定其它条款。在一般情况下,此类条款可通过特别决议予以修改,但也可能作出不准许修改的特别规定。此类条款最常用于规定不同种类股份的特别权利。由于章程大纲的效力优于章程细则,此类条款的规定如与章程细则抵触,仍具有法律效力。

公司章程细则的内容及其修改

1、公司章程细则的内容

公司章程细则的主要内容是规定公司经营管理的内部规则,调整有关成员的权利、董事的权力与义务、红利分配以及利润资本化等事项。如果公司股份分为不同种类,也规定于章程细则。

公司条例未要求股份有限公司登记其章程细则。值得注意的是,如果某公司未登记其章程细则,将被推定为《公司条例》附件一表A的章程细则模板适用于该公司。为了保持选择适用该模板条款的灵活性,公司通常都登记其章程细则。如果公司的章程细则未明确排除或修改该模板中的规则,这些规则将是适用的。如果公司不采用该模板,应在其章程细则第1条具体规定。

《香港公司条例》附件一表A第二部分,即私人股份有限公司章程细则模板规定,公众股份有限公司章程细则模板除第24条(有关股份转让)之外,适用于私人股份有限公司;此外,私人股份有限公司的章程细则应包括《香港公司条例》第29条第1款的规定。

2、公司章程细则的修改

《香港公司条例》第13条规定,根据该条例的规定和公司章程大纲的条件,公司可通过特别决议修改其章程细则的规定。任何修改均被视同包含于在公司注册署登记的公司章程细则,需要通过特别决议才能再作修改。在第13条中对修改章程细则的唯一限制是,禁止公司作出任何影响不同股份权利的修改或添加。这显然是为了保护特定种类股份的持有者,因为他们可能不具有足以否决特别决议的表决权。

法院也可能在某些情况下限制公司对其章程细则的修改。例如,法院可责令公司修改其章程细则以防止对小股东的压迫,公司不能在其后通过特别决议再次修改其章程细则,撤销原有按院要求所作的修改。法院还可在当事人申请的情况下,以不符合公司成员的整体利益,宣布公司对章程细则的修改无效。在实践中,法院将允许公司对章程细则所作的绝大多数修改,因为它推定,公司管理人员最了解公司的利益。然而,允许公司以不充分理由逐其成员的章程细则条款,可能被法院否定。

公司章程大纲与章程细则的法律效力

根据《香港公司条例》第23条,章程大纲与章程细则一经登记,对公司和公司成员均具约束力。公司各成员,无论是否是章程大纲的签署者,均受章程大纲和章程细则规定的约束。

这种法定合同具有如下效力:

- 章程大纲和章程细则在公司和各成员之间构成了合同,产生两方面的后果,即各成员通过章程细则的规定受到公司的约束,公司本身也受到各成员的约束;

- 各成员在同其它成员的关系方面受到了章程大纲和章程细则规定的约束。因此,如果某成员未能遵守章程大纲或章程细则的规定,其它成员可对该成员起诉,不必要求公司代表其起诉;

- 第三人即使以不同的资格作为成员,也不具有章程大纲和章程细则规定的权利。 因此,在章程细则中有关董事酬金的规定,在董事成为公司成员的情况下,不能由该董事执行。此类规定只有在同该董事签署的合同中有明示或默示规定的情况下,才是可执行的。